The Evolution of Australia’s Superannuation Industry and Keegan Adams Recruitment’s Strategic Role

The Rapid Transformation of the Superannuation Sector The Australian superannuation industry is undergoing a period of rapid transformation, driven by consolidation, regulatory shifts, and the internalisation of investment management. As of the September 2024 quarter, total superannuation assets reached $4.1 trillion, reflecting a 3.7% increase over the quarter. This growth underscores the sector’s critical role…

Published on March 25, 2025

The Rapid Transformation of the Superannuation Sector

The Australian superannuation industry is undergoing a period of rapid transformation, driven by consolidation, regulatory shifts, and the internalisation of investment management.

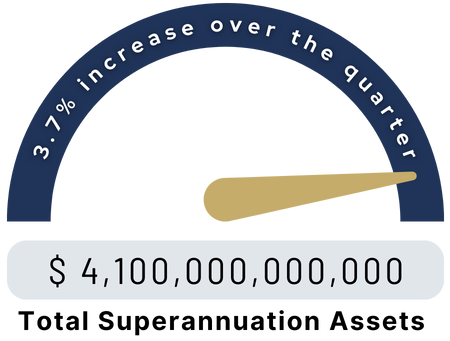

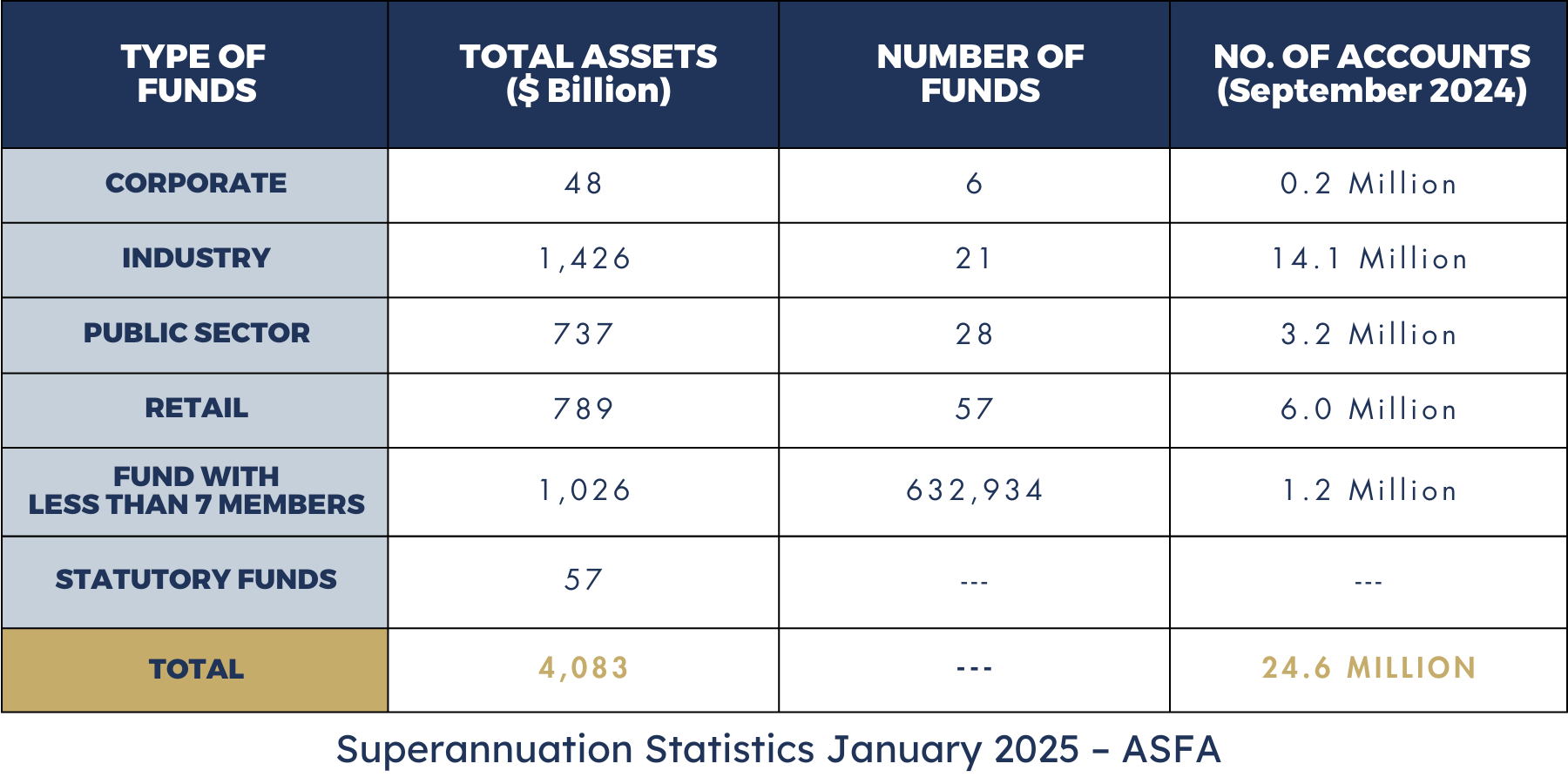

As of the September 2024 quarter, total superannuation assets reached $4.1 trillion, reflecting a 3.7% increase over the quarter.

This growth underscores the sector’s critical role in both domestic and global financial markets.

Regulators such as APRA continue to advocate for consolidation, deeming funds with less than $30 billion in assets “uncompetitive”.

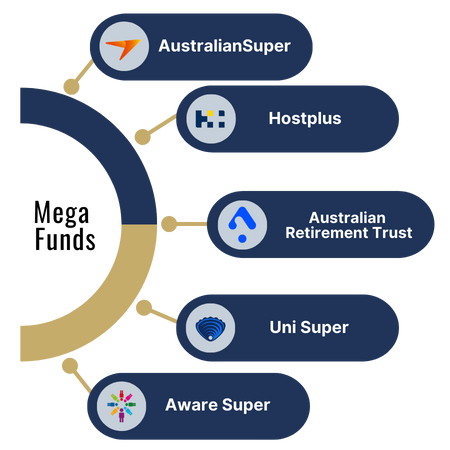

This has resulted in significant mergers, including the formation of Aware Super from First State Super and VicSuper in 2020 and the creation of the Australian Retirement Trust (ART) from Sunsuper and QSuper in 2022.

Consequently, five mega-funds—AustralianSuper, ART, Aware Super, UniSuper, and Hostplus—have emerged, with others like HESTA, Rest, and Cbus poised to follow suit.

Internalisation and the Demand for Skilled Talent

With consolidation and asset growth, superannuation funds are increasingly internalising investment strategies.

Rather than outsourcing, they are adopting an asset management model, directly handling portfolios, and expanding into global markets.

This shift has prompted the establishment of international offices in the UK and the US to access investment opportunities in infrastructure, real estate, private equity, and private debt.

As these funds scale, the demand for skilled professionals has intensified.

Keegan Adams Recruitment plays a strategic role in this evolution, supplying top-tier talent across investment management, project management, ESG, operations, risk, and compliance.

Our expertise ensures that superannuation funds build high-performing teams capable of driving innovation and operational excellence.

Technology and Operational Uplift

To manage increasing complexity, superannuation funds are investing in advanced technology platforms and operational infrastructure. Legacy systems are being phased out in favour of digital-first solutions that improve member engagement and streamline fund management.

A key concern is ensuring super funds can adequately support members transitioning into retirement. Poor service delivery risks positioning superannuation providers as “just big rapacious engines,” akin to the banks and insurance companies of the early 2000s.

Industry leaders highlight the necessity of cultural transformation within super funds. Improved call centres, AI-driven support systems, and data-driven financial advice are seen as crucial steps forward. Some funds have already designated dedicated teams to focus on retirement solutions, acknowledging 2024 as a pivotal year for change.

Many funds are integrating cutting-edge platforms such as Aladdin, E-Front, Goldensource, Charles River, Bravura Sonata Alta, Eagle Performance Management, Snowflake, and ServiceNow. These technologies enhance investment processes, member services, data management, and risk analytics.

With the removal of default corporate super funds, competition for members has intensified. This has led to increased investment in marketing, digital engagement, and communication strategies. Additionally, fee compression has placed pressure on vendors and service providers to deliver cost-effective solutions while maintaining high-quality outcomes

Regulatory Changes and Retirement Solutions

From 1 July 2025, the superannuation guarantee (SG) rate will rise to 12%, reinforcing the importance of employer compliance. Meanwhile, regulatory bodies such as the ATO, ASIC, and APRA continue to drive changes in reporting, transparency, and member engagement strategies.Despite its growth, the industry still faces challenges in developing comprehensive retirement solutions.

Integrated retirement offerings, improved financial advice access, and enhanced engagement strategies require robust operational frameworks. However, underdeveloped infrastructure remains a significant barrier, highlighting the need for continuous innovation.

The Global Reach of Australian Superannuation

Australia’s superannuation sector is not just a domestic powerhouse—it is evolving into a major global investor. Super funds are among the country’s largest exporters of capital, investing heavily in international markets to diversify risk and optimise returns.

With nearly $400 billion already invested in the US, the industry aims to increase this figure to $1 trillion by 2032. Australian funds are also working with policymakers to navigate trade barriers, such as steel and aluminium tariffs, to enhance investment opportunities.

Finding the Right Talent to Drive Superannuation Evolution

As the industry continues to mature, securing and retaining top talent is paramount.

Salary packages, employee value propositions (EVP), and workplace benefits are evolving to attract professionals who can drive regulatory compliance, operational efficiency, and strategic investment growth.

Diversity, Equity & Inclusion (DE&I) has also become a key focus, with asset owners spearheading initiatives to create inclusive workplaces.

Keegan Adams Recruitment remains at the forefront of this transformation, providing skilled professionals who can navigate industry changes and support long-term success. For more insights on how Keegan Adams Recruitment is shaping Australia’s superannuation industry, contact our team today.

Published on March 25, 2025