Funds Management Distribution Market Update 2025

The Australian funds management distribution market is experiencing significant transformation as we move into 2025. In the face of evolving industry dynamics, fund managers are contending with a declining financial adviser base, institutional market consolidation, intensifying competition, fee compression, and shifting investor preferences. This update delves into the key trends, challenges, and opportunities shaping the…

Published on January 14, 2025

The Australian funds management distribution market is experiencing significant transformation as we move into 2025. In the face of evolving industry dynamics, fund managers are contending with a declining financial adviser base, institutional market consolidation, intensifying competition, fee compression, and shifting investor preferences. This update delves into the key trends, challenges, and opportunities shaping the market, offering actionable insights on how fund managers can adapt and succeed in this changing environment.

1. The Shift to Direct-to-Consumer Models

One of the most pressing challenges for fund managers is the continued decline in the number of financial advisers in Australia, which has dropped below 16,000, according to the latest Wealth Data figures. This reduction has prompted fund managers to explore direct-to-consumer (DTC) distribution models, mirroring trends observed in other global markets. The shift to DTC requires fund managers to establish direct relationships with investors and offer seamless, high-quality digital experiences that align with the growing demand for consumer-grade interactions. To compete in this evolving environment, fund managers must enhance their digital capabilities and tailor their offerings to effectively engage and retain investors.

2. Superannuation Fund Mergers and Market Consolidation

The Australian superannuation market is undergoing continued consolidation, driven by external pressures such as cost-efficiency mandates and the performance benchmarks introduced under the Your Future, Your Super (YFYS) legislation.

This trend is expected to result in a market dominated by a few large mega-funds, making fund managers to adapt their strategies to align with the preferences of these dominant institutions.

To remain competitive in this evolving environment, fund managers must prioritise scale, efficiency, and performance. By doing so, they can remain competitive in the evolving environment.

3. Managed Accounts: Growth and Adoption

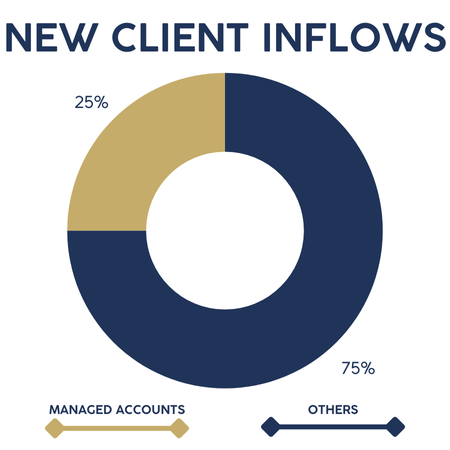

According to a report by Investment Trends and State Street Global Advisors, managed accounts currently represent 25% of all new client inflows. Furthermore, 56% of financial advisers are already utilising these solutions, with this figure projected to climb to 75% in the near future.

This surge in adoption is primarily driven by the demand for greater portfolio management efficiency, especially during periods of market volatility. Managed accounts also stand out for their ability to deliver tailored, growth-oriented investment strategies, is a key selling point of managed accounts, and fund managers who can effectively leverage these solutions are poised for success.

Fund managers who can effectively integrate managed account offerings are well-positioned to capitalise on this growing trend, enhancing their competitiveness in an evolving market.

Reference: https://www.professionalplanner.com.au/2024/06/the-rise-and-rise-of-managed-accounts/

4. Asset Consultants

The growing prominence of asset consultants in Australia has transformed the investment landscape. As more advisers and financial institutions seek expert guidance, these consultants have become key players, serving as gatekeepers between advisers and investment products.

Their influence has expanded significantly, driven by advisers increasingly outsourcing investment selection—particularly after the Hayne Royal Commission and the FOFA reforms. Asset consultants now play a critical role in managing governance structures, ensuring compliance, and promoting best practices across the industry.

However, while the sector has experienced rapid growth, there is an ongoing demand for greater transparency and a clearer understanding of the diverse players within this space.

5. Client Channel & Investors Preferences Shift

The consolidation of superannuation funds is reshaping the institutional distribution landscape. Institutional teams are becoming leaner, and the internalisation of investment strategies, coupled with the demand for passive investments, has presented significant challenges for active fund managers.

To adapt, Institutional Business Development Managers are shifting their focus toward alternative sources of institutional capital, such as insurance firms, not-for-profit organisations, endowments, and sovereign wealth funds. Additionally, wealth management firms, high-net-worth clients, asset consultants, and family offices are emerging as increasingly important targets, requiring fund managers to refine their distribution strategies to cater effectively to these markets.

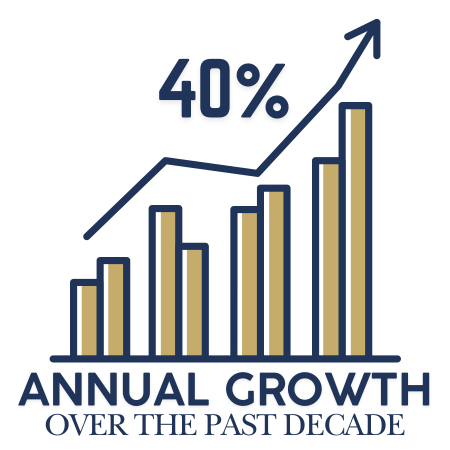

Exchange-Traded Funds (ETFs) are also witnessing surging interest as investors prioritise cost-effective and flexible investment solutions. As of late 2024, total assets under management (AUM) in Australian ETFs reached a record high of AUD 140 billion, reflecting growing investor demand. According to Morningstar, Australian ETFs have achieved an impressive annual growth rate of 40% over the past decade, driven by investor preference for cost-effective investment solutions and portfolio diversification.

ETFs’ appeal lies in their low expense ratios, significantly undercutting those of actively managed funds, making them an attractive choice for cost-conscious investors. Furthermore, ETFs’ stock-like tradability enhances their flexibility and liquidity, that solidifying their position in the investment landscape.

As institutional teams streamline operations in response to client channel consolidation, fund managers must build the right capabilities to meet the unique needs of clients, offering bespoke investment solutions.

6. The Rise of Private Credit and Alternative Investments

Private credit and other alternative investments are gaining traction in the Australian funds management distribution market as investors increasingly seek diversification and higher yields. These investment products are particularly appealing to institutional investors and high-net-worth individuals who prioritise stable, long-term returns.

Fund managers who can incorporate alternative investments such as private equity, private credit, infrastructure, and real estate into their strategies will continue to see strong demand and capital inflows.

7. The Growing Importance of Business Development Managers (BDMs)

As the funds management distribution market grows increasingly complex, the role of Business Development Managers (BDMs) has become more critical than ever. BDMs with extensive networks and deep expertise are instrumental in navigating the evolving distribution channels, including the shift from wholesale to direct-to-consumer models.

Their ability to cultivate relationships with key stakeholders—such as institutional clients, wealth management firms, and family offices—is pivotal in ensuring a competitive edge. Furthermore, BDMs play a crucial role in helping fund managers stay ahead of distribution trends by effectively communicating their value propositions and aligning strategies with market demands.

8. Market Compensation Trends for Distribution Professionals

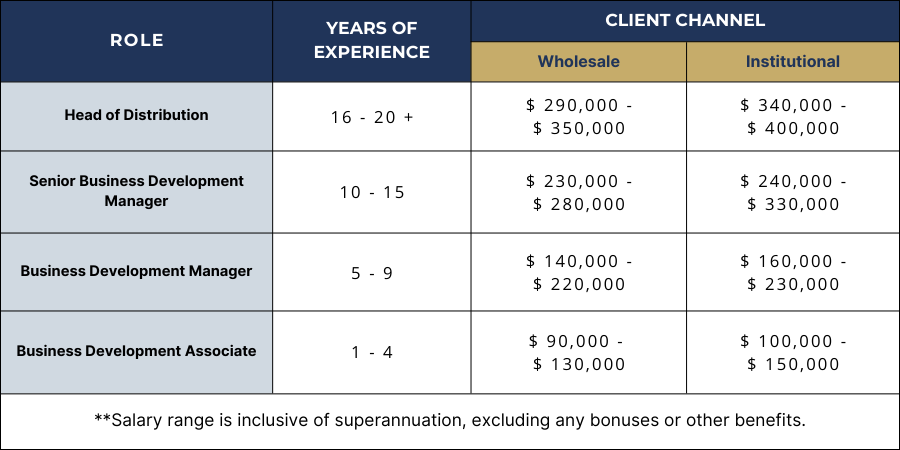

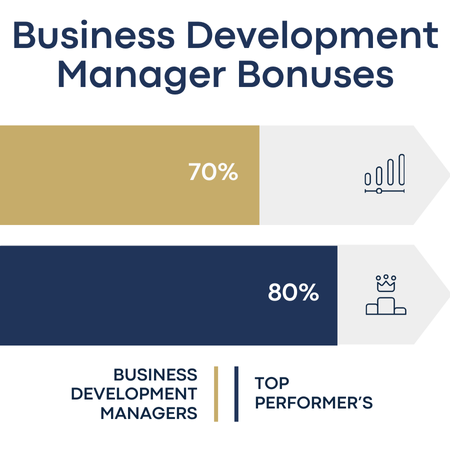

The majority of firms prefer to hire Senior BDMs who already have established relationships in the local market, rather than investing years in training and developing junior candidates. In 2024, BDM bonuses ranged from 25% to 70% of base salary, with top performers earning bonuses exceeding 80%.

To attract and retain top talent, firms are also enhancing their employee value propositions (EVPs) by offering bonuses, education allowances, and health and wellness benefits.

9. Investment Products: Asset Class Exposure

Equities and fixed-income products remain critical to the Australian funds management landscape. However, there is a notable surge in interest in alternative investments, particularly private credit, infrastructure, and real estate. This trend reflects investors’ growing desire for diversification and long-term, stable returns.

Moreover, specialised investment strategies are increasingly preferred over multi-manager products, underscoring the importance of clear value propositions and consistent performance across key asset classes.

Conclusion: Navigating a Complex Market

The Australian funds management distribution market is experiencing rapid and transformative change, shaped by evolving investor preferences, market consolidation, client channel shifts, regulatory developments, and the growing prominence of alternative investments.

To remain competitive, fund managers must recalibrate their distribution strategies to effectively engage both traditional and emerging channels. Success will hinge on the ability to leverage experienced business development managers, deliver strong and differentiated product offerings, and cultivate a compelling employee value proposition.

Looking ahead, the growth of managed accounts, the rise of private credit, and the expansion of digital and direct-to-consumer models will redefine the market’s trajectory. By embracing these trends and proactively adapting to the evolving landscape, fund managers can secure a competitive edge and achieve sustainable growth in 2025 and beyond.

Published on January 14, 2025