Are you satisfied with your bonus?

In 2024, the Australian investment and wealth management industry is navigating a period marked by changing market conditions, regulatory shifts, and evolving workforce expectations. Bonuses and salary increases have become critical factors in attracting and retaining top talent, especially as firms strive to balance performance incentives with cost management amid uncertain economic landscapes. Trends…

Published on November 5, 2024

Jack Brown

In 2024, the Australian investment and wealth management industry is navigating a period marked by changing market conditions, regulatory shifts, and evolving workforce expectations. Bonuses and salary increases have become critical factors in attracting and retaining top talent, especially as firms strive to balance performance incentives with cost management amid uncertain economic landscapes.

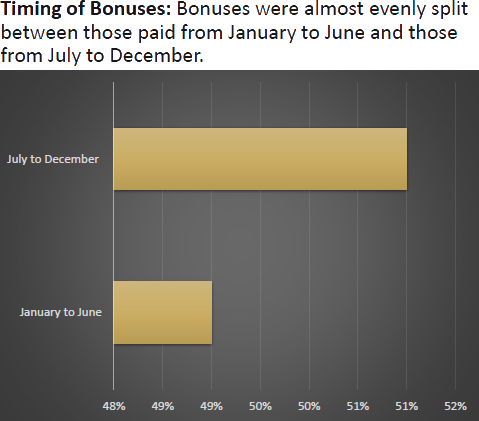

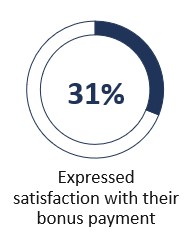

Trends in Bonuses

This shift aims to foster a culture of accountability and to ensure that compensation packages align with the company’s global financial health. In high-demand areas such as private equity and asset management, salary and bonus has been a regular topic through 2024.

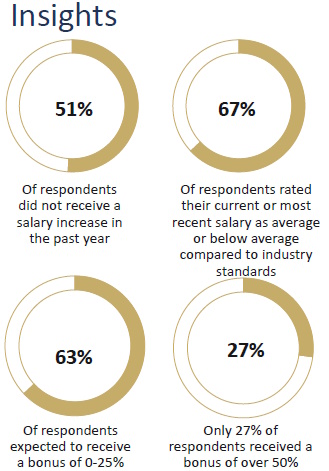

Salary Increases in 2024

The tight labour market and increased competition for certain skillets have put upward pressure on salaries in 2024. In response, many firms awarded salary increases to retain key employees and to attract new talent, resulting in a lower allocation of overall budgets for less staff. This is particularly notable in Melbourne and Queensland, where lower volumes of talent create more demand for experienced talent.

Early-career professionals that began careers in the last 2-3 years have seen above market entry salaries, which have been marginally increased and still higher than more norms prior to COVID. These employees, often drawn to the sector for its growth potential, often have an expected salary growth to match their career progression. Therefore, we have seen younger employees more inclined to switch firms for higher pay if career growth seems limited.

Balancing Short-term and Long-term Incentives

This shift reflects an industry-wide recognition of the need for sustainable talent strategies. Long-term incentives, such as stock options or partnership opportunities, are increasingly part of compensation packages, particularly for senior professionals. These incentives align individual goals with firm success, promoting stability and loyalty among employees who see their future tied to the organisation’s ongoing achievements.

Impact of Economic and Regulatory Factors

The industry’s approach to compensation in 2024 is also shaped by macroeconomic and regulatory factors. Rising inflation and potential interest rate changes impact financial performance, leading some firms to be more cautious with salary increases and bonuses.

At the same time, the introduction of new regulatory frameworks around responsible investment and client transparency has created additional pressures on compliance teams, prompting some firms to introduce specific bonuses and salary increases for roles that help navigate these regulatory requirements.

Conclusion

As the Australian investment and wealth management industry adapts to new realities, firms are recognising the importance of competitive and fair compensation structures to attract and retain top talent. With a mix of performance-based bonuses, regular salary increases, and long-term incentives, the industry is evolving its approach to meet the demands of both current employees and prospective talent, ensuring continued growth and resilience in an ever-changing financial landscape.

Published on November 5, 2024

Jack Brown